The Advantages of Doing Business in Australia Part II: The R&D Tax Incentive Program and How it Could Benefit You

Introduction:

The Australian Federal Government’s R&D Tax Incentive Program, arguably one of the most generous tax incentives globally, is surprisingly easily available to both Australian technology companies and similar Overseas establishments that have a presence in Australia.

The Incentive offers generous tax offsets to companies undertaking R&D activities in Australia. In addition, pre-approved Overseas R&D activities (and associated expenditure) are also eligible.

Benefits:

The R&D Tax Incentive offers two categories of tax offsets:

- For eligible companies with an aggregated (global) turnover of greater than AUD $20Min any one financial year, there is a non-refundable 38.5% tax offset. This typically equates to a tax offset (reduction in tax liability) of between 8.5% - 11% (depending on the specific company tax rate).

For example, if an R&D company incurs $1,000,000 AUD in eligible R&D expenditure, that company can get a reduction in their tax liability (i.e., tax payable) of between $85,000 and $110,000 AUD.

If a company is in tax losses, the non-refundable offsets are carried forward to future tax years, when they can be used to offset future tax liabilities.

- For eligible companies with an aggregated turnover of less than $20M AUD in one financial year, there is a refundable 43.5%tax offset. This typically equates to a refundable tax offset of between 13.5% and 16% (depending on the specific company tax rate).

For example, if a R&D company incurs $1,000,000 in eligible R&D expenditure, AND that company is in tax losses (as many early-stage start-ups are), that company can get a $435,000 (cash) refund through their lodged tax return.

If a company is profitable, an accountant is able to more accurately assess the quantum of refundable offsets or reduction in tax liability.

There is a cap of $100M AUD on R&D expenditure that can be subject to the relevant R&D Tax offset. Any amounts beyond that figure are subject to normal corporate tax rates.

This Program then becomes very attractive to those in the Life Science sector, usually on account of the not-insignificant amounts necessary for the various phases of clinical trials (see Australia’s expertise in this regard later on).

Additional Benefits:

Foreign-Owned R&D:

In order to attract Overseas talent to collaborate with Australia, the R&D Tax Incentive Program offers a unique incentive to companies based Overseas.

Companies from countries with a Double Tax Agreement (DTA) with Australia can, with relative ease, set up a permanent establishment in Australia. The presence of any (overseas) company staff is optional, as the minimum legal requirement for such a company in Australia is for an Australian permanent resident or citizen to be appointed as a local Non-Executive Director. Australian professional services companies can assist in day-to-day business administrative roles, while R&D activities themselves may be contractually outsourced to Australian Consultants or Contractors (refer to earlier descriptions of these).

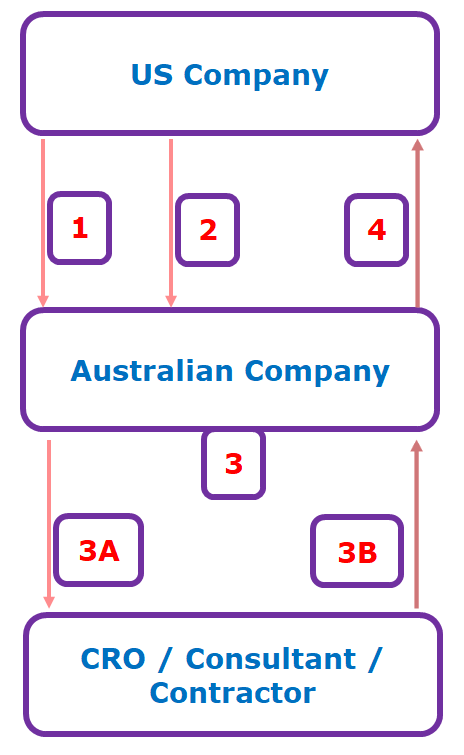

The process is best described with the aid of the following illustration:

Step 1:

The Overseas company establishes a permanent establishment (subsidiary or parent company) in Australia.

Step 2:

The Overseas company formally contracts the related Australian company to undertake R&D activities on behalf of the Overseas company.

The Overseas company may choose to fund the Australian R&D activities.

Step 3:

The Australian company undertakes the R&D activities in Australia.

Step 4:

The Australian entity sends the results of the R&D activities (IP) to the Overseas company, which then owns that IP.

The Overseas company may choose to reimburse the Australian company for the IP.

Step 3A:

If the Australian company does not have the relevant Scientific capability of Research/Technical personnel, they may opt to contract the R&D out to an Australian Contractor or Consultant.

Step 3B:

In this case, the Australian company must own the results of the R&D (IP), and then ultimately send that to the Overseas company (Step 4).

In the above scenario, the Australian entity is eligible to claim the relevant R&D Tax offset for all R&D expenditure incurred in Australia.

In the case where the Australian company is reimbursed by the related Overseas company, the Australian company can still claim the R&D Tax Incentive, as it meets the three major eligibility criteria (see Eligibility above).

Overseas R&D Activities:

Quite often, Australian companies undertaking R&D projects conclude that specific aspects of their R&D project cannot be undertaken in Australia.

Following investigations, such a company establishes that the expertise sought for their R&D projects simply do not exist, or are not immediately available to them in Australia.

This expertise may encompass such things as:

- access to expert knowledge (researchers, scientists),

- access to specialised equipment (unique engineering or technical machinery,

- access to specific living organisms (population groups [for clinical trials]; quarantine issues [viruses, plant material]; natural habitats), and/or

- access to geological features (soil, oil spills, rare/toxic chemicals)

In these instances, the company can apply to AusIndustry for an Overseas Finding, wherein the company puts forward a substantiated case as to the reasons why certain aspects of their R&D projects have to be undertaken Overseas and not in Australia. These reasons are based on the 4 criteria listed above.

Once approved, the Finding allows such companies to claim the costs of those Overseas activities as part of their R&D Tax Incentive claim, and enjoy the higher tax offset benefit for those offshore activities.

An Australian company, related to an Overseas company, can therefore undertake certain aspects of their R&D projects Overseas, and claim the costs of the (approved) Overseas activities as part of their R&D Tax Incentive claim.

This is true even if the Australian IP is being sent to the related Overseas company – via the Foreign-Owned R&D provisions.

Timing:

The Australian tax/financial year operates from July to June of the following year. However, many American (& other) companies in Australia can apply for a Substituted Accounting Period – to align with that of the Overseas entity.

The AusIndustry application for Local R&D activities must be lodged within 10 months after the end of a specific financial year. That is, for the financial year ended 30 June 2020, eligible companies have 10 months - until 30 April 2021 – within which to prepare and lodge their AusIndustry applications.

During this time, the company – using records maintained throughout the year – calculates the eligible R&D expenditure amounts. These are forwarded to the company accountants, who incorporate these amounts in the company’s tax return. There is usually a short turnaround period, after which the Australian Taxation Office processes any R&D Tax refunds owing to the company. These tax refunds are deemed non-assessable income, and may be used by the company as they deem appropriate.

Many start-ups use these funds to further their R&D, employ new staff, or pay their founders.

Conclusion:

On 06 October 2020, the Australian Treasurer announced in the 2020-21 Budget, that the rate of the refundable tax offset not be affected by the expected decrease in the corporate tax rate.

This is a remarkable commitment to encouraging R&D, and in particular, to provide tangible incentives for SMEs to continue making technological advances.

The Program is one of the most generous in the world, and covers a wide range of activities and expenditure items.

The regulatory bodies have fairly simple and straightforward compliance requirements in the form of records and evidence that the R&D Tax claimants need to maintain on a contemporaneous basis.

A well-respected Regulatory Advisory company – Brandwood CKC – has estimated that US companies can save up to 60% of their development and clinical trial costs by undertaking these in Australia.

Furthermore, they’ve suggested that getting approval for some FDA-equivalent approvals and registration requirements takes a few weeks in Australia as opposed to many months in the USA. Australia’s equivalent of the FDA is the Therapeutic Goods Administration (TGA - https://www.tga.gov.au/).

It is also well known that many Life Science companies use Australia’s TGA regulatory compliance framework to ‘springboard’ their developments for more efficient and faster FDA approvals in the USA. This is due in part to the FDA recognising TGA approvals and registrations as being equivalent and meeting the strict requirements.

There are a number of Overseas companies that are currently making use of this Program (including the Foreign-Owned and Overseas Finding provisions), and their refundable tax offsets have often been in the millions of AUD.

However, any Overseas company wishing to explore the options outlined above needs to carefully consider the various issues that will impact such a decision. The trusted advice of relevant business professionals should be sought to confirm the feasibility of proceeding with some of the suggestions mentioned here.

Related Reading:

http://www.bio4p.com/fastnews/26484.html

文章评论(0)